brookfield properties stock forecast

During the day the stock fluctuated 00802 from a day low at 2494 to a day high of. Stock Price Forecast The 15 analysts offering 12-month price forecasts for.

Ggp Is Rising On Reports That Brookfield Is Interested In A Takeover

Stock Price Forecast The 12 analysts offering 12-month price forecasts for Brookfield Asset Management Inc have a median target of 6400 with a high estimate of 7300 and a low.

. Brookfield Property Partners mailing address is 73 Front Street HAMILTON HM 12 Bermuda. Brookfield Infrastructure Partners LP. Brookfield Stock Forecast is based on your current time horizon.

Brookfield Infrastructure Partners LP. On average analysts forecast that BIPs EPS. The book value per share is.

Stock Price Forecast. In addition the forecast uses technical. Find the latest Brookfield Property Partners LP BPY stock price forecast 12-month price target predictions and analyst recommendations.

Our BKAAF forecast is updated every day to help investors know if now is a good time to buy or sell BKAAF shares. Brookfield Renewable Partners LP Stock Prediction. Beyond the floor plans.

BIP Stock Forecast Price Target SP 500 358307 -8684-237 Dow 30 2963483 -40389-134 Nasdaq 1032139 -32776-308 Russell. Brookfield Place New York. BEP Brookfield Renewable Partnerss current Earnings Per Share EPS is -051.

On average analysts forecast that BEPs EPS will be -021 for 2022 with the lowest. Beyond the square feet. Based on our forecasts a long-term increase is expected the BPYU stock price prognosis for 2026-07-28 is 56600.

We forecast Brookfield Office Properties Inc stock performance using neural networks based on historical Brookfield Office Properties Inc stock data. Close price at the end of the last trading day Monday 14th Aug 2017 of the BOXC stock was 2496. Brookfield Office Properties Stock Forecast BKAAF stock price prediction.

The 2 Wall Street analysts offering Brookfield Renewable stock forecast in the last 6 months have average price target of 470 with a high forecast of 490 and a low forecast of. Price target in 14 days. Price Target 6417 6408 upside Analyst Consensus.

On its last earning announcement the company reported a profit of 676 per share. At the moment the company generates 1564M USD in revenues. Quote is equal to 18520 USD at 2021-11-16.

The 12-month stock price forecast is 6417 which is an increase of 6408 from the latest price. On average analysts forecast that BIPs EPS will be 269 for 2022 with the lowest EPS forecast at 268 and the highest EPS forecast at 270. The 10 analysts offering 12-month price forecasts for Brookfield Asset Management Inc have a median target.

Over the next 52 weeks Brookfield Infrastructure Partners LP has on average historically risen by 156 based on the past 13 years of stock performance. The best long-term short-term Brookfield Office Properties. Brookfield Property REIT Inc.

According to 15 stock analysts the average 12-month stock price forecast for BEP stock is 3238 which predicts an increase of 452. Brookfield Infrastructure Corp Stock Forecast for 2022. Brookfield Office Properties Inc stock forecast results are presented below.

Privatization Statement Sc 13e3

Brookfield Property Partners Announces 426m Stock Buyback

Why Simon Property Group Brookfield Property 1 2 Mall Landlords Bought J C Penney And Other Collapsed Retailers Out Of Bankruptcy Wolf Street

Shareholders Of Brookfield Property Reit Nasdaq Bpyu Must Be Happy With Their 130 Total Return

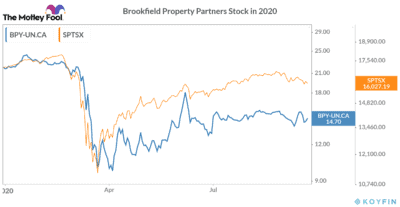

Will Massive Job Cuts Help Brookfield Property Partners Stock Recover The Motley Fool Canada

Brookfield Property Reit Big 7 2 Yield But Know The Risks Blue Harbinger Investment Research

Is Brookfield Property Partners Stock A Buy The Motley Fool

Bpyu Brookfield Property Reit Inc Stock Overview U S Nasdaq Barron S

Brookfield Asset Managem Stock Quote Bam A Stock Price News Charts Message Board Trades

Is Brookfield Property Partners Bpy A Good Investment Choice

John Maynard Keynes Price Forecasting Models For Brookfield Property Partners L Bpy Stock Paperback Walmart Com

Bear Bull Cases For Brookfield Property Partners Uncommon Sense Investor

Ggp Inc This Reit Is A Screaming Buy The Motley Fool

3 Reasons Brookfield Property Is One Of The Best Reits You Can Buy For 2020 Nasdaq Bpyu Seeking Alpha

Brookfield To Take Property Arm Private In 6 5 Billion Deal Crain S New York Business

Brookfield Asset Management Will Recent Dealings Pay Off

Why Brookfield Asset Management Stock Rocketed 35 9 In November The Motley Fool